The Best Stocks With Perfect Trade Setups

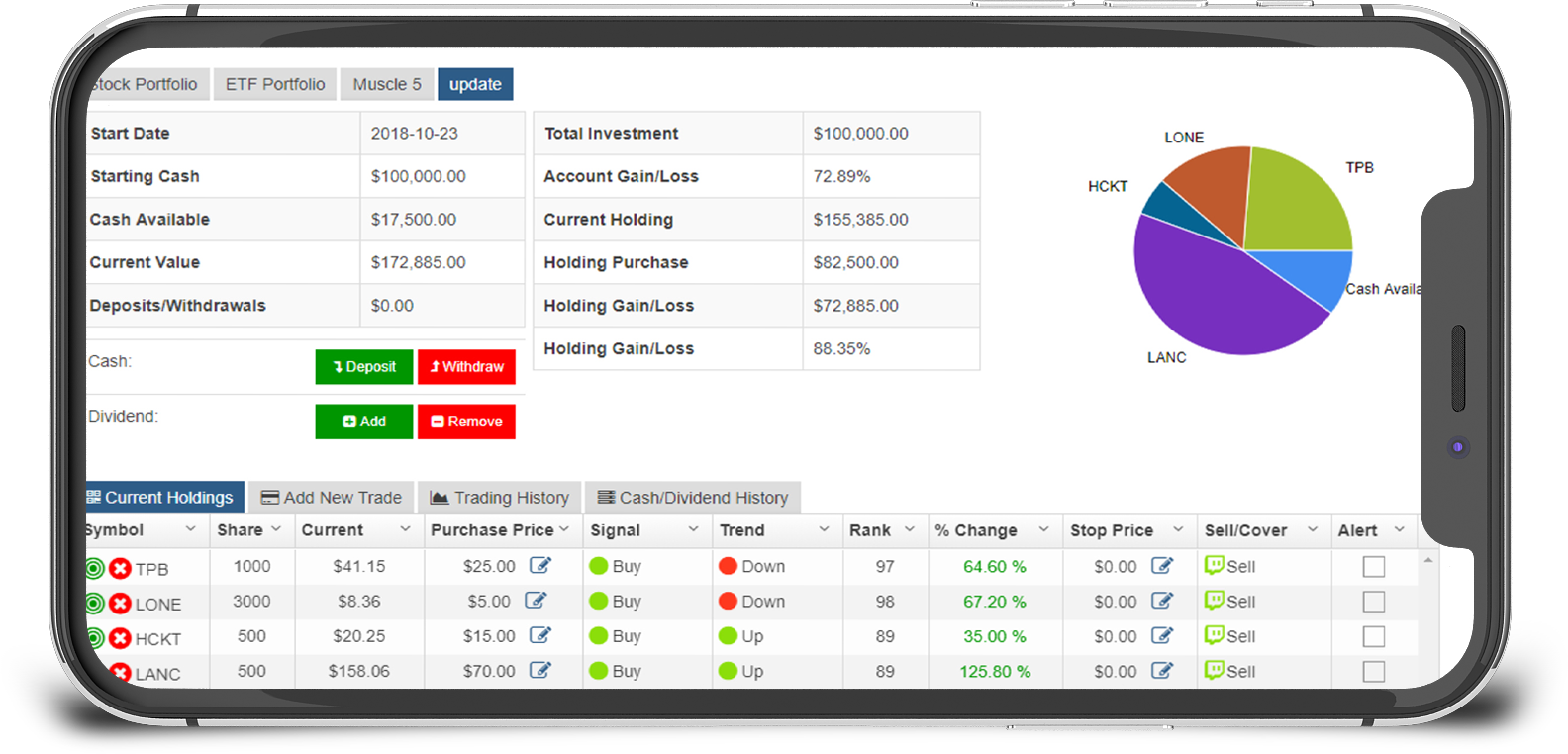

Easy-To-Use Stock Screening and Analysis Software

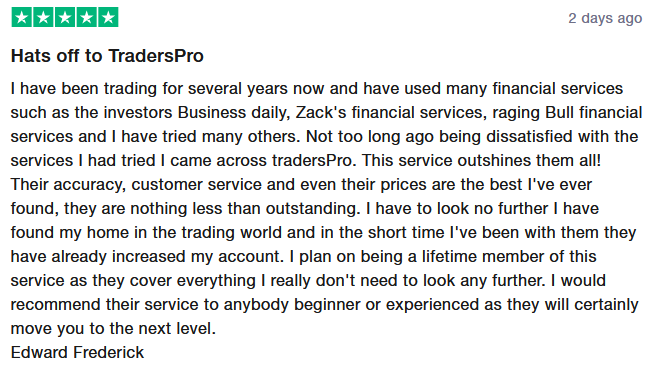

There are only a few stocks worth your time and attention. TradersPro gives you the top stocks daily. Learn how the momentum zone gives you an easy-to-use, non-emotional stock picking and trading system. Don't let costly emotions keep you from holding losers too long and selling winners too soon.

Which Stock Is Next and Will You Own It? Or Will You Be Left On The Sidelines?

Every new bull market has groups of stocks that move up in very powerful trends. Sometimes increase by 1,000% in a single up trend that could last months.

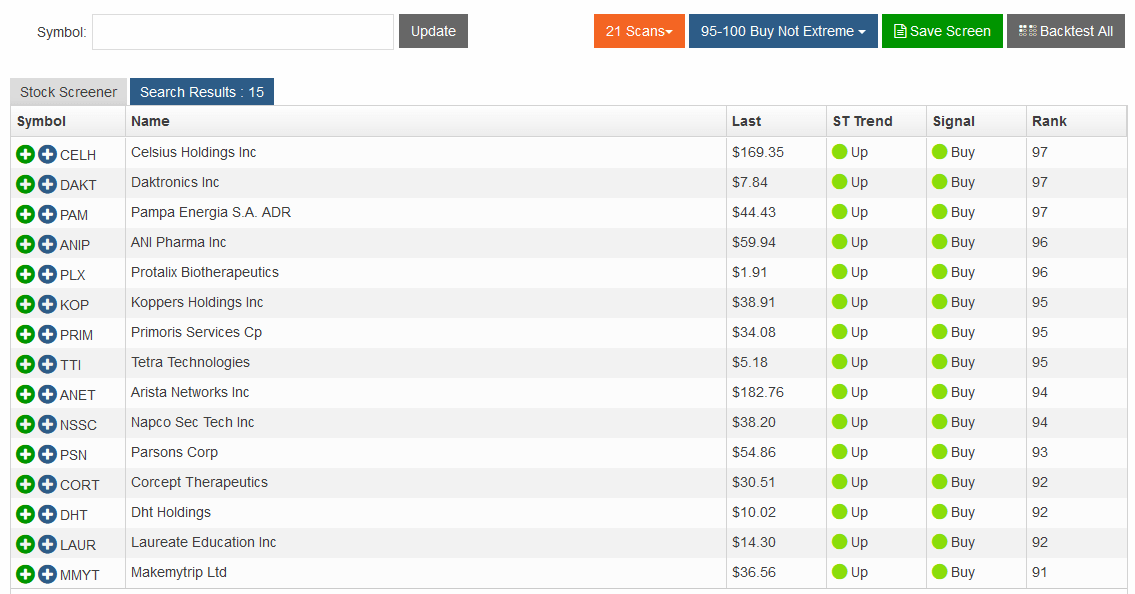

TradersPro filters the best stocks for you to focus on daily using a powerful momentum algorithm. Up, down or sideways markets, there are always great stocks moving higher.

Find Top Stocks To Trade Each Day

Systematic method allows

you to follow a plan...

you to follow a plan...

Leverage by 10X by Trading Options

Clear signals with exact

entry and exit points...

entry and exit points...

Easy-To-Use - Anyone Can Use It

If you can use a keyboard and click a mouse

you can do this...

Systematically Find Huge Winners

The reason this system produces such incredible results is its ability to pinpoint stocks on the verge of increasing 100%-300% or more in 6 to 12 months.

Don't let trading emotions keep you from meeting your financial goals.

This exclusive signal software delivers only the best stocks to you daily and keeps you in profitable trades longer producing astonishing results.

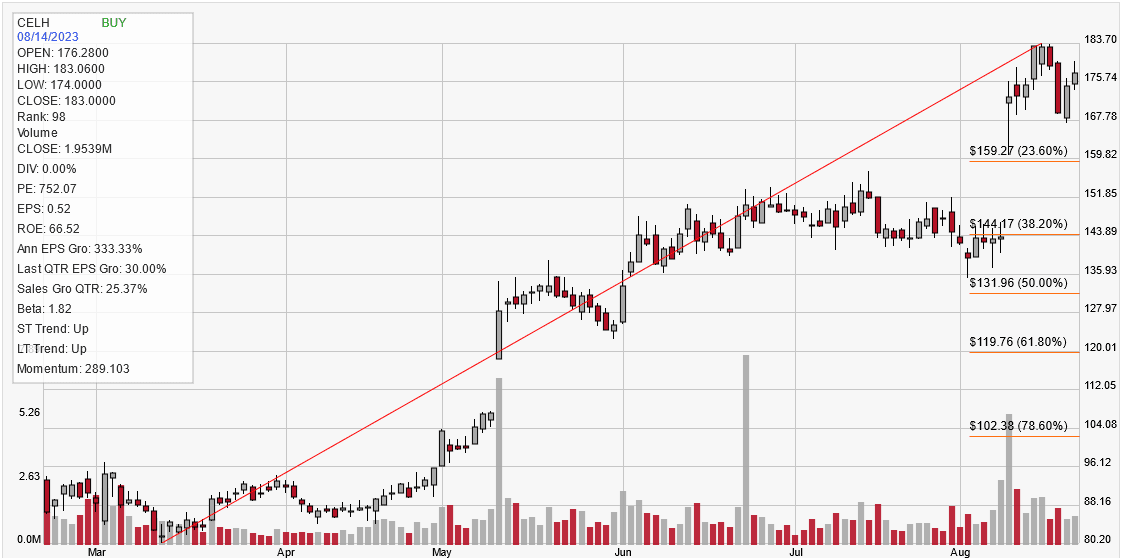

A stock needs a growing company to increase in value over time.

Momentum and growth stocks require a specific set of criteria to surge higher.

Rank, Momentum, volume, EPS (Earnings Per Share) growth, and sales growth are the powerful combinations to focus on.

Watch the next video to learn how to screen for fast-growing companies.

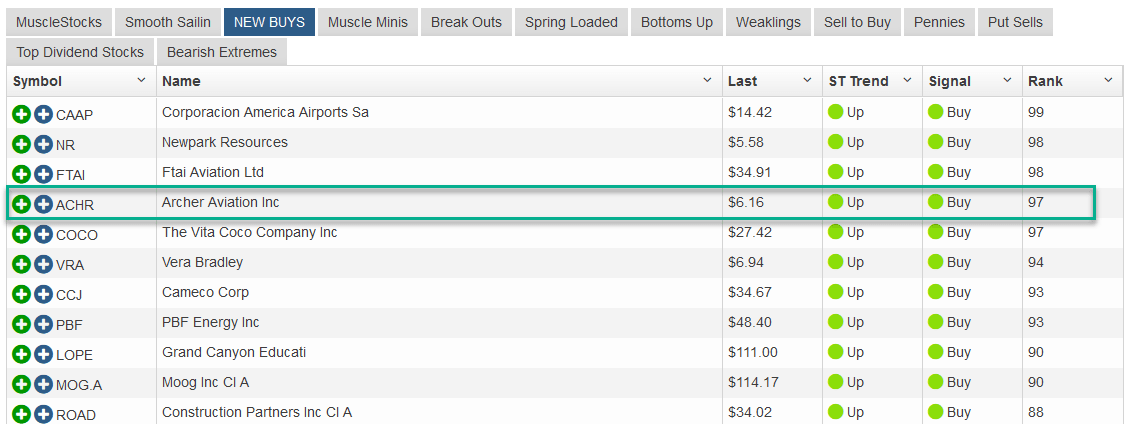

Powerful Screener Finds New and Emerging Technology Ideas

What if you want to be able to participate in new and emerging technology ideas that could provide opportunities for huge growth like Microsoft, Netflix or Amazon in the beginning phases of their decade’s long growth. TradersPro powerful momentum scans find any publicly traded stock that is building momentum.

How To Find The Best Stocks

A stock price is simply the present value of the future earnings of a company. A great stock requires a great company. Here is how you can screen for the best.

Click The Image To Play Video

#1 Stock To Buy Now

Follow Us On YouTube

TradersPro is an easy-to-use stock picking software that identifies leading growth and momentum stocks for you daily. Watch our morning updates free on YouTube each morning at 9 am EST.

Premier Suite - Monthly

$79 $19.95/mo

Full Feature Software Access.

Click for full plan features

TradersPro Signals and Analysis

TradersPro Premium Features

Special Bonus Items

Premier Suite - Annually

$397 $119.95/yr

Full Feature Software Access. (Save 50% off monthly)

Click for full plan features

TradersPro Signals and Analysis

TradersPro Premium Features

Special Bonus Items

Start Your Investing Journey Now

Just Sign Up & Get Things Done...

TRADERSPRO © 2024. All Rights Reserved

265 N Main St. D283 | Kaysville UT 84037 | USA